As the consumer landscape drastically moves into the digital realm, companies and industries are continuously investing in innovation, technology and new processes and business models that allow them to keep up with digital-first societies. More than rethinking products and offerings, companies are now facing major overhauls of their corporate structures, processes and mindsets. While this process of reinvention affected virtually every area, few others were as greatly impacted by it as the financial industry.

As one of the top digital laggards of the last decade, banks have been put to great efforts in what regards innovation, not only by new players such as Fintechs and Neo-Banks, but also by disruptive regulatory requirements such as PSD2 and Open Banking. However, despite their best efforts, there is still a long road ahead for financial institutions to fully embrace the Digital Banking Transformation.

More than simply investing in an omnichannel approach where existing products and services are made available to consumers across multiple channels, financial institutions must rethink their corporate strategies from a Customer-Centric Perspective. Digital-First consumers are more informed and demanding, mostly due to the extremely high standards regarding customer experience and service they have previously enjoyed in other areas like retail. To meet these client’s expectations and keep them engaged throughout their journeys, financial institutions must quickly adapt their structure, culture and mindset.

Enter Digital Customer Onboarding

As the first point of contact with potential customers, onboarding processes have a striking impact on customer’s perception and the future relations that follow. With current processes taking up to 12 weeks to complete and requiring several in-branch interactions, many banks are out-of-sync with their clients, who favour digital channels for most of their banking needs. In fact, the ability to remotely engage with clients and seamlessly provide them with dedicated offers across a multitude of channels has become invaluable for financial institutions.

Besides this customer-oriented approach, the digitization of traditional onboarding processes will allow banks to considerably reduce overall onboarding duration, cut operational costs by as much as 20% and drastically reduce the use of paper and highly polluting printing ink. With onboarding costs amounting to roughly $230 million every year, it’s easy to understand why most banks have made it a priority.

In order to improve on both these fronts, financial institutions must resort to Digital Banking Platforms. On the one hand, these orchestrators unify information from multiple channels on the same platform, making it easily accessible on different devices and stages of the customer journey; on the other, the digitization of documents and processes greatly accelerates interactions and reduces costs. Supported by these Digital Platforms, banks are now able to provide true omnichannel experiences to their potential and existing clients.

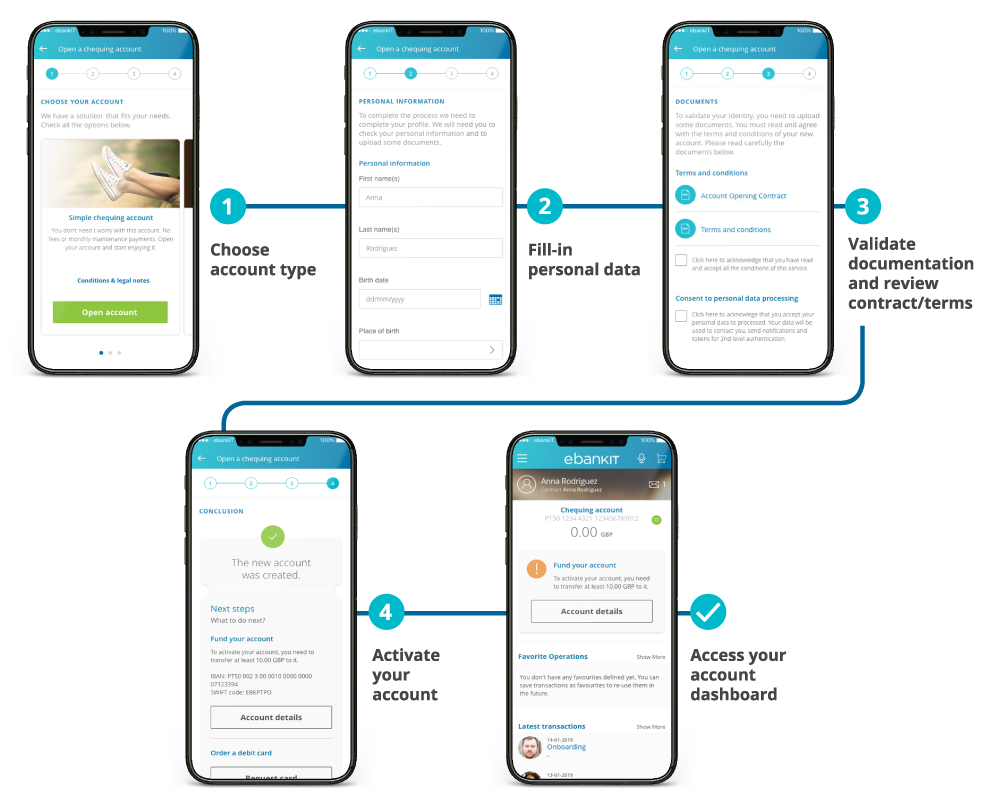

ebankIT Digital Onboarding

With a Digital First approach, ebankIT’s Omnichannel Digital Banking Platform is fully prepared to help financial institutions create a true omnichannel experience that engages clients each step of the way. Our Mobile App provides a simple, user-friendly interface, where potential clients can create their digital accounts in just 5 simple steps and without having to resort to any exterior information or webpages. The whole process takes roughly 2/3 minutes to complete uses the very same app customers will use after subscribing for banking products or services, making it quite familiar from the start. Additionally, the process can be paused and resumed at a later stage, on any device, without losing the previously filled information.

The modular architecture of our Digital Banking Platform allows for extra flexibility, with modules being added or removed according to the financial institution’s specific needs. It is also easily adaptable to their reality, adjusting to local legislation and legal requirements, language and internal processes. Furthermore, our solution supports third-party integration from the leading experts on a number of technological fields such as K.Y.C., biometrics and document recognition among others. By incorporating added functionalities for other developers, we are able to deliver a solution that continuously evolves to meet new requirements and market demands.

%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp?width=160&height=57&name=67768-ebankIT%20Platform%20-%20CMMI%20Development%20V2.0%20(CMMI-DEV)%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp)