As societies evolved into more globalized and ever-connected digital clusters, allowing free access to never-ending arrays of information, consumers became much more informed, demanding and selective. Before, banks relied solely on their branches for customer acquisition – customer path was linear and well defined as was the decision-making process. Nowadays with consumers becoming digital natives and the widespread implementation of digital banking solutions, understanding customer journeys poses much more of a challenge. Despite the traditionalism associated with the banking industry, today’s customers are going digital and favor the comfort of their homes over visiting physical branches.

In fact, strictly digital journeys through various channels are quickly becoming the standard, avoiding branches altogether. As such, knowing how customers interact with your each of your touch points and mapping their journeys is invaluable to keep one step ahead and deliver unparalleled customer experience. Understanding how your customers engage in different channels will allow you to adapt your offerings to the right channel, at the right time.

It’s all about the customer

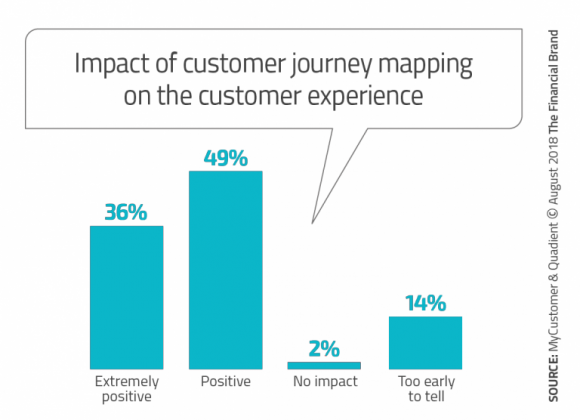

With banking being heavily hit by a loyalty crisis in the last 5 years, with over 55% of customers switching banks (Salesforce), Customer Experience is currently the top priority for about 89% of companies (Gartner), as a means of differentiation from its competitors. One of the fundamental tools that allows companies to excel at customer experience is precisely customer journey mapping (CJM), which has reportedly seen increases of up to 81% on client satisfaction upon implementation (MyCustomer & Quadient). By optimizing the communication, timing and offerings on each of the touch points customers contact with, banks will be able to deliver seamless experiences on all channels, thus providing positive costumer experiences.

As such, costumer experience has become the prime competitive factor in the banking industry, with companies undergoing massive changes in positioning and processes to become increasingly customer-centered. It is also banking’s most valuable tool in the digital age, not only to maximize customer acquisition but mostly to ensure customer retention and loyalty.

How can ebankIT improve customer experience?

The shift towards digital means customers will be researching online for information to support their decisions. The ability to deliver optimized digital touch points to serve customers will not only separate companies from the competition, it will also slowly build a relation with customers on each step of the way. Through its omnichannel platform ebankIT is able to deliver a range of customer-driven interfaces, thoroughly customized to ensure a seamless experience. From dedicated Customer Channels including Online, Mobile and Watch banking, to front-office channels such as Contact Center and Branch Front-Office, ebankIT’s front-ends will allow you to collect and analyze financial and contextual data from customers.

With ebankIT solutions, banks will be able to:

- Adjust and improve offers in real-time

- Preemptively deliver the right offer, on the right channel at the right time

- Access customer needs in each major life events

- Get unique insights of customers’ context

- Map customer journeys and increase customer experience

%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp?width=160&height=57&name=67768-ebankIT%20Platform%20-%20CMMI%20Development%20V2.0%20(CMMI-DEV)%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp)