One of the inherent aspects of living in a digital age is undoubtedly the fast-pace at which change happens. In a most Darwin-esque fashion, company’s ability to adapt is now more important than ever: what used to be a differentiating trait for success has now become a survival requirement. This is true for all business areas but even more so when it comes to banking, whose core is often marked by traditionalism and resistance to technological innovation.

Going digital is no longer a matter of choice for banks who want to remain relevant and competitive. The main concern now is understanding whether their core-banking systems and digital interfaces can adapt to continuous changes, be them to capture new business opportunities or simply comply with new requirements and regulations. On the latter, Financial Institutions are now facing a major challenge: becoming PSD2 compliant.

Changing Paradigms

The second Payment Services Directive (PSD2 for short), is part of a global trend in bank regulation, with strong emphasis on security, innovation, and market competition. Simply put, the Directive requires banks to grant third party providers, connectivity to access their customer’s accounts. It enables bank clients (private or corporate) to choose third-party providers to manage their finances, ending the monopoly of account information and payment services banks held until now.

While the concept is in itself, quite disrupting, even more so are the processes and costs associated with its implementation it in traditional banking. For most banks, integrating new functionalities such as integration with AISPs (Account Info Service Providers) and PISPs (Payment Initiation Service Providers) represent arduous processes and elevated costs, not only with IT, but also with logistics and staff training.

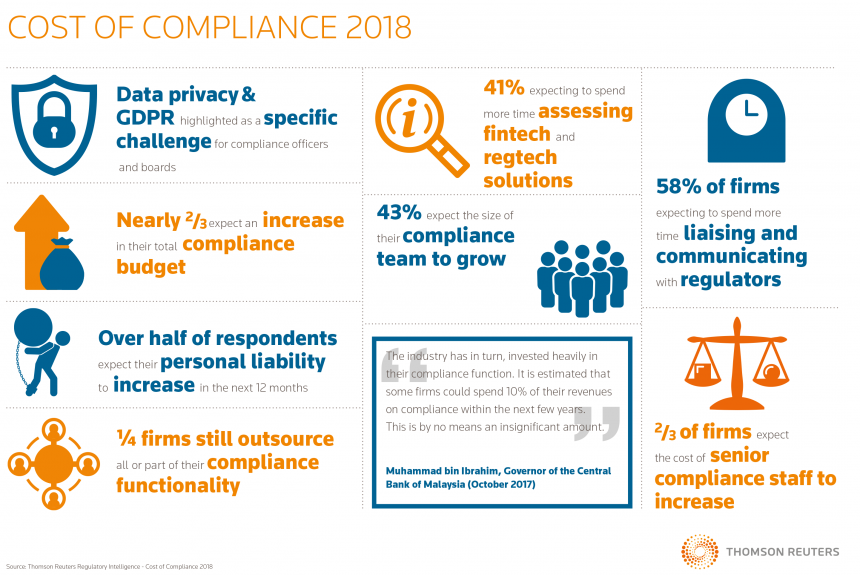

In fact, according to a survey conducted by Duff & Phelps, financial institutions typically spend 4% of their revenue on compliance, but this amount is estimated to increase to 10% by 2022. Furthermore, compliance requirements are similar across the board, placing a heavy regulatory burden on smaller institutions who must ensure them with fewer resources than their larger counterparts. However, such burdens can be largely reduced by resorting to affordable, compliance-driven software, an area where Fintechs definitely shine.

Ongoing cost-effective compliance with ebankIT

ebankIT’s core-agnostic platform, besides integrating with virtually all core banking systems, has a unique architecture with a wide range of modules and solutions. Its API GATEWAY for instance, allows communication with External Systems which, in the case of PSD2 is a mandatory requirement. Through it, we are able to seamlessly articulate interactions with AISP and PISP, granting them access to the required customer and account information, at a fraction of the time and cost.

ebankIT delivers a complete solution with several integrated tools that will always allow up to keep up with the latest business opportunities, market demands and regulatory requirements. Besides making your bank PSD2 compliant, our platform will allow you to:

- Continuously adapt to new regulations and compliance requirements;

- Ensure the highest standards of privacy and security;

- Adjust to new market demands and business opportunities;

- Ensure timings for the implementation regulatory requirements are met;

- Reduce compliance costs;

See it in action!

Ready to take the next step in the Digital Transformation of your Bank?

Request a Demo by filling in this form and learn how ebankIT’s Omnichannel Platform can help you achieve it in record time and at a fraction of the cost.

%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp?width=160&height=57&name=67768-ebankIT%20Platform%20-%20CMMI%20Development%20V2.0%20(CMMI-DEV)%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp)