Banking-as-a-Service, or simply BaaS, has become one of those expressions that most people in the banking business have already heard of. Its influence does not cease to grow, as financial services become more and more widely spread, but most market stakeholders are still unaware of its true potential. Banking-as-a-Service is opening the door for a new market approach, where banking structures become more flexible, and financial institutions increasingly engage with their end-consumers.

It’s a defining trend within the digital revolution that definitely came to stay, and it is keen to expand. First, it was Open Banking to reshape the banking business: with the use of open Application Programming Interfaces (APIs), the fintech ecosystem gained access to data from the banking sector and started to build applications around each financial institution. Now, the revolution goes even further, with many third-party distributors offering banking products in their catalogs. With BaaS, a growing number of non-banks – such as airline companies or e-commerce platforms – are starting to offer financial services, in order to enhance their core business proposition.

This emerging tendency unlocks a new wave of opportunities for the banking and the fintech system. BaaS strategy widens the financial landscape, embracing a large number of valuable brands. Companies that have already established strong customer loyalty (take Apple, Nike, or Sony, for example) can now offer financial services, such as credit solutions or debit cards with cash back rewards. This joint offer, from both banking institutions and direct-to-consumer brands, takes benefit from long-standing customer relationships and eases the access to financial services. Customers can purchase these services at the point of sale, without being redirected to a different channel.

Even though, this business strategy can be perceived by banks and credit unions as a technological threat, it is keen to work out as a win-win situation for both banking system and their end-customers. Nowadays, consumers expect digital transactions to be fast, intuitive, and frictionless. Banking-as-a-Service is a crucial step to meet those demands and it will make the banking system closer to their client’s financial lives. Engaged with their customers’ consumer habits, banks will also be able to tailor more customized solutions.

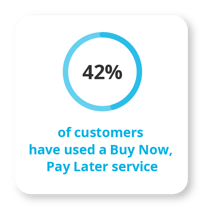

Moreover, BaaS also represents a step further for the inclusion of unbanked and underbanked people. Simpler financial services – such as the “Buy Now, Pay Later” approach – become even more intuitive when offered by commercial brands. This phenomenon introduces a new audience to the banking system. With BaaS, these new customers find the best of both worlds: the convenience of financial services through an on-demand platform and the robustness that comes from a licensed banking institution.

Moreover, BaaS also represents a step further for the inclusion of unbanked and underbanked people. Simpler financial services – such as the “Buy Now, Pay Later” approach – become even more intuitive when offered by commercial brands. This phenomenon introduces a new audience to the banking system. With BaaS, these new customers find the best of both worlds: the convenience of financial services through an on-demand platform and the robustness that comes from a licensed banking institution.

Several countries already started to introduce open banking regulation, indicating that the financial services industry is moving towards an era where shared data and modular infrastructure will become the standard and not the exception. Undoubtedly, BaaS and API-Banking will soon become as ubiquitous as online or mobile banking, probably just another channel that every bank must build and maintain. The first banks and credit unions that embrace this new business strategy will soon be ahead of the curve, and likely rewarded with high demand.

This may seem like a challenge that’s either too big – or too far down the road – to solve, especially for smaller banks and credit unions. There is no doubt that banking technology is intrinsically complex and expensive to develop from the very beginning. But those same local financial institutions, with a community-based strategy, are also the ones who can win the most out of this new and more engaging approach. The solution relies on adopting external services and integrated solutions. ebankIT’s omnichannel digital platform is an example of such a ready-to-use solution, enabling financial institutions to build stronger relationships with their audience, but also prepared to integrate with other third-party solutions.

%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp?width=160&height=57&name=67768-ebankIT%20Platform%20-%20CMMI%20Development%20V2.0%20(CMMI-DEV)%20without%20SAM%20-%20Maturity%20Level%20-%202-KO%20edit.webp)